Lifetime Renewability

As per the new IRDAI – Health Insurance Regulations 2016 guidelines, each insurance company has to introduced lifetime renewability of all their health insurance policies. With the new guidelines, if you have a policy issued in your name, you can continue to renew the policy for your lifetime. An insurer shall now not deny the renewal of a health insurance policy on the ground that the insured had made a claim or claims in the preceding policy years. However, policy renewal can now only be declined – on grounds of fraud, moral hazard or misrepresentation or non-cooperation by the insured. If the policy is withdrawn, then the insurer has to move the policyholder to another similar plan offered by him.

Coverage for Pre-existing Diseases

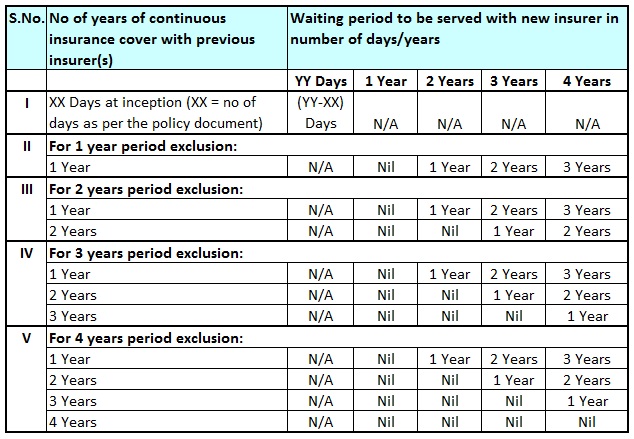

The pre-existing diseases waiting periods and time bound exclusions will be streamlined and shall be taken into account as follows:

- In case the waiting period for a certain disease or treatment in the new policy is longer than

that in the earlier policy for the same disease or treatment, the additional waiting period should be

clearly explained to the incoming policy holder in the portability form to be submitted by the

porting policyholder. - For group health insurance policies, the individual members shall be given credit as per the

table above based on the number of years of continuous insurance cover, irrespective of, whether

the previous policy had any pre-existing disease exclusion/time bound exclusions.

Withdrawal of Indemnity Health Insurance Product by Life Insurer

Life Insurers may offer long term Individual Health Insurance products i.e., for term of 5 years or more, but the premium for such products shall remain unchanged for at least a period of every block of three years, thereafter the premium may be reviewed and modified as necessary.

Now life insurer will not offer indemnity based products either Individual or Group. All existing indemnity based products offered by life insurers shall be withdrawn as specified under these Regulations.

With regard to specific withdrawal of indemnity based health products offered by life insurers pursuant to the provisions of Regulation 3 (b) of these Regulations, the product shall be closed by giving a prospective date of closure not later than three months from the date of notification of these Regulations. For existing policyholders, the policy shall continue until the expiry of the respective policy term.

Discount for Wellness

Insurers will introduce a new incentives to reward policyholders for early entry, continued renewals (wherever applicable), favourable claims experience, preventive and wellness habits and disclose upfront such incentives will be clearly defined in the prospectus and the policy document. No discount shall be offered on any third party service or merchandise. However, discounts in premium or discounts and/or benefits on diagnostic or pharmaceuticals or consultation services of providers in the network are permitted.

New Pilot Products

Insurer may offer innovative health covers, will called as ‘Pilot products’. Pilot products can only be offered by General and Health Insurers for policy tenure of one year. Every Pilot product may be offered upto a period not exceeding 5 years.

After 5 years of launch of the pilot product, the product will needs to get converted into a regular product or based on valid reasons may be withdrawn subject to the insured being given an option to migrate to another product subject to portability conditions. Where a pilot product gets converted into a regular product, any exception made in these Regulations for pilot products shall no longer apply and the insurer shall ensure compliance with all the provisions of these Regulations.

Credit or Loan linked Health Insurance

Group Health Policies may be offered by any insurer (Life, General or Health) for a term of one year, except credit linked products, where the term can be extended up to the loan period not exceeding five years. General Insurers and Health Insurers may also offer Credit Linked Group Personal Accident policies for a term extended upto the loan period not exceeding five years.

Group Insurance

Group Health Policies may be offered by any insurer (Life, General or Health) for a term of one year, except credit linked products. The Group size will be determined by the Insurer which shall be applicable for all its group policies. However the group size should be minimum of 7, to be eligible for issuance of a Group Insurance Policy.

No Agent Commission for Insurance Portability

No commission shall be payable to agent or intermediary if you port your policy to new insurer.